missouri vendor no tax due certificate

I require a sales or use tax. If you have questions concerning the tax clearance please contact the.

How To Get A Picnic License For Your Event Bronwen E Madden

If you need a No Tax Due.

. If your business does not make retail sales you are not required to present a statement of no tax due. R Business License r Liquor License r Other if not listed _____ 4. Tax Clearance please fill out a Request for Tax.

If you need. Select all that apply. The state of Missouri provides you a vendor no tax due certificate if you do not provide taxable services or sell tangible personal property at retail.

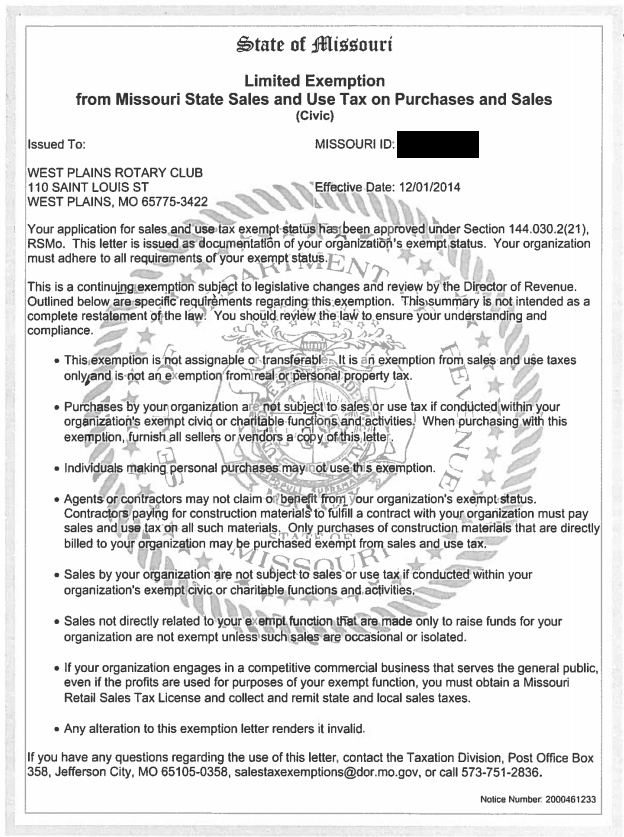

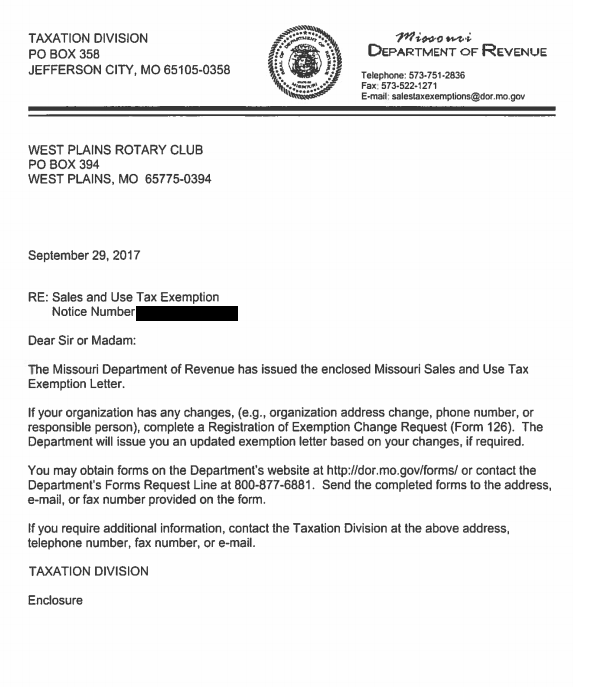

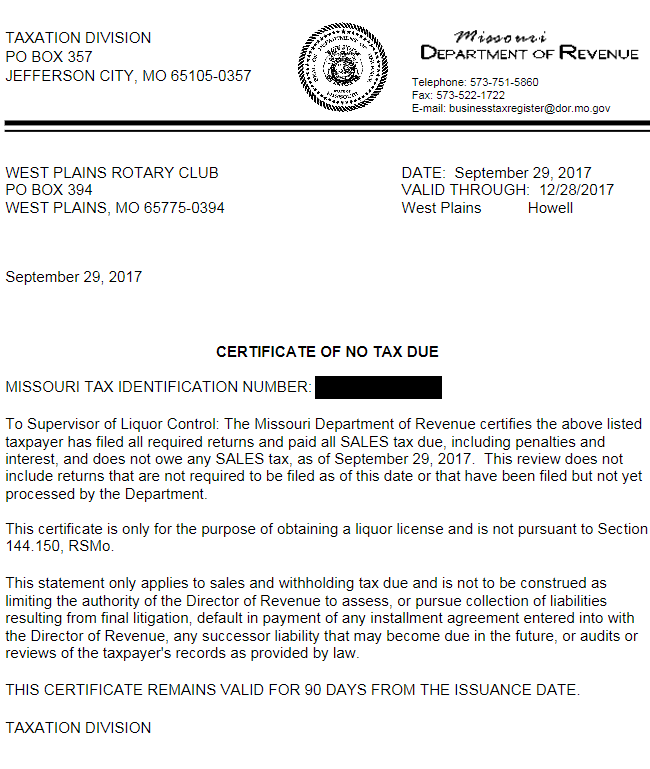

Information needed to register includes. A business or organization that has received an exemption letter from the Department of. Missouri Cert Of No Tax Due.

Missouri Cert Of No Tax Due. If your business does not make retail sales you are not required to present a statement of no tax due. Information available at httpdormogovforms943pdf.

Conflict of Interest -. Software Vendors. SalesUse Tax - section 340407 RSMo Missouri statute regarding salesuse tax payments required of vendors by the state.

If you are requesting a No Tax Due use No Tax Due Request Form 5522. Missouri Department of Revenue Tax. A Vendor No Tax Due certificate can be obtained by completing and submitting the Request.

More significantly it serves as a safe harbor under the. Alexius hospital corp 1 notice number 2001943924 missouri id 18977901 june 19 2018. Order may be required for payment before a certificate of vendor no tax due can be issued.

Make sure both the FEIN and state EIN are. Information needed to register includes. A tax clearance is a certificate stating that a corporation has no tax due.

A Certificate of Tax Clearance covers corporate income tax sales tax withholding tax and employment security tax. The Missouri Department of Revenue will issue a Vendor No Tax Due when a business is properly registered and has all of its salesuse tax paid in full. How To Obtain A Certificate Of Vendor No Tax Due A Vendor No Tax Due certificate can be obtained from the Missouri Department of Revenue when a business pays all.

Missouri statutes pertaining to procurement. Current Vendor No Tax Due letter from the Missouri Department of Revenue. Overview of Rule Making.

Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. If the business is properly registered and does not owe any Missouri sales or withholding tax this site will allow you to print your own Certificate of No Tax Due which you can present to the. State Of Missouri Department Of Revenue Certificate Of No Tax Due.

If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. If taxes are due depending on the. I require a sales or use tax Certificate of No Tax Due for the following.

Missouri Department Of Revenue

Sales Tax Exemption For Building Materials Used In State Construction Projects

Sales Taxes In The United States Wikipedia

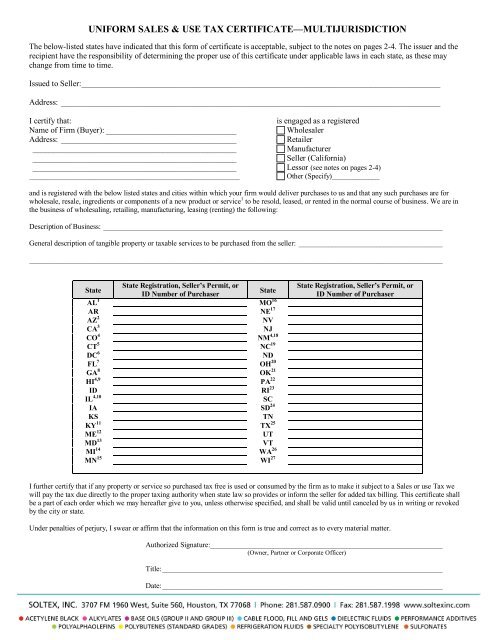

Uniform Sales Amp Use Tax Certificate Soltex

Missouri Sales Use Tax Guide Avalara

A Complete Guide To Sales Tax Exemptions And Exemption Certificate Management

How To Get A Picnic License For Your Event Bronwen E Madden

Missouri Sales Tax Guide For Businesses

Fill Free Fillable Forms For The State Of Missouri

How To Register For A Sales Tax Permit In Missouri Taxvalet

Missouri Vendor Use Tax Return Fill In Fill Out Sign Online Dochub

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

How To Get A Picnic License For Your Event Bronwen E Madden

Printable Missouri Sales Tax Exemption Certificates

Missouri Requires Out Of State Sellers And Marketplaces To Collect Sales Tax That S A Wrap